[[{“value”:”

Lead Generation offers have always been one of the favorite verticals of many affiliates including me who has been obsessed with Life Insurance Lead Generation since 2015. Conversions are easier to get than CPA offers, and there’s a wide variety of sub-verticals and niches to choose from — giving affiliates the flexibility to select those best suited to their audience (if they have a traffic source that they know well enough).

To top it off, there’s always a new offer available for whatever niche you are working on when the old one dies out or no longer converts!

If you’re looking to promote lead gen offers and can’t choose a niche, why not try life insurance?

Life insurance is something that everyone, at some point, will need to consider, making it an evergreen niche for marketers. It’s not a seasonal product or a passing trend — it’s a constant, stable market with a broad audience base.

If you have enough time, patience, and testing budget for advertising, you can make life insurance lead gen offers a consistent source of affiliate income.

Why Facebook/Meta Ads?

Facebook is known to be pretty strict with the ads they allow. This strictness means you can only promote White Hat offers or use a White Hat strategy (Grey Hat, too, if you’re feeling adventurous and willing to risk your advertiser account — but we’re not going to talk about those here).

This Meta platform’s traffic quality can go from average to good. While it may not offer the best quality compared to sources like Google Ads, it makes up for it with manageable advertising spends. The cost may even be reduced once your campaign has settled or once you’ve found a great ad and landing page combination.

The downside is that it is strict on all aspects of the ad: the ad creative itself and the landing pages must follow all of Meta’s requirements, down to the last detail. If not, even when you get approved initially, your ad will eventually be rejected or will get shadow-banned.

Plus, your account can get disabled for any reason. The closest you’ll get to an explanation is the policy they say you broke.

You’ll have to dig deep within your campaigns to find the root cause. Even worse, you might have to delete all your previously running campaigns to start fresh. Reactivating the account takes a while, if it gets reactivated at all.

But with all these cons, Facebook is still a great place to advertise. For one, it has more than 3 billion monthly active users. With this many users, it would be foolish to ignore this traffic source.

You can also pinpoint your exact audience with crazy accuracy.

So, while the costs per click can be higher, and there’s a risk that you’ll lose your advertising access right in the middle of running campaigns, the conversion rate and approval rates are also better than others.

It can undoubtedly turn out to be really profitable if you know what you’re doing.

And that’s where this guide can help.

Develop Your Marketing Strategy

Before diving head first, you need to develop a marketing strategy.

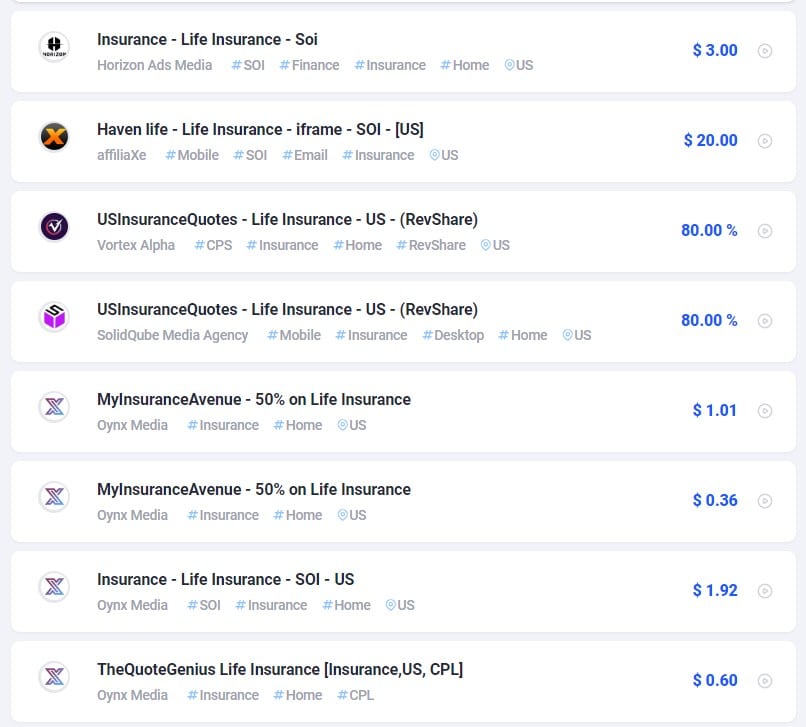

Choosing an Offer

To get started, you must first select the country you want to target.

In 2021, over $600 billion worth of Life Insurance was written in the US, making it the top country for this industry. It is followed by China, Japan, the United Kingdom, Germany, France, South Korea, Italy, Canada, and India as the top 10 countries for life insurance.

For my favorite market The UK life insurance is relatively small however competition is also less as compared to other markets..

If you opt to promote to any of these countries, you’ll surely have a good list of lead-gen offers to choose from.

Tier 2 and Tier 3 countries are also good places to start — if you want to go where there’s less competition.

Once you’ve narrowed down your list of offers, the next thing to do is identify your target audience. There’s a good chance this information is already provided by the advertiser or the affiliate network, so make sure you check the affiliate program terms and details.

Most of the time, the advertiser already has a list of targeting information on audiences that convert well for them (or at least, these are the customers that they are looking for).

You’ll get info on countries and traffic types accepted, and maybe even the device, gender, and age group.

Sometimes, they will even indicate the schedule that they accept leads for when the offer requires their call center to contact the user immediately. When leads are sent on weekends or out of office schedule, the lead will eventually turn cold.

Leads sent outside of the schedule will not be accepted or paid, so you’ll end up wasting money if you’re not careful.

Identifying Your Target Audience on Facebook

If the affiliate program did not specifically indicate the kind of customers that they’re looking for, I suggest you start with audiences that have a high chance of converting.

According to research by Forbes, the COVID-19 pandemic is a driving factor in the increased awareness and appreciation of life insurance, with 30% of their respondents planning on buying life insurance right now.

The demographics of people who are feeling the urgency to buy life insurance in the US right now are:

Millennials (45%)

African Americans (38%)

Men (33%)

People who earn more than $150,000 per year (42%)

Use these indicators when you are targeting your audience on Facebook since these are the ones most likely to convert.

In addition, the following demographic proved to convert well for life insurance lead gen offers even before the pandemic:

Users aged 40 and above

Parents with young children

To be more specific, US Males aged 40 and above who have young children convert best.

Now, based on the target audience you identify, you can narrow it down in Facebook by:

Location – Target by Country, State/Region, or City. At the start of your campaign, don’t go too narrow; target by country first and trim your target location later on if you’d like to focus on specific locations.

Gender – Targeting Men works best, but there’s no harm in promoting to Women as well.

Age – Aged 40 and above is best, but if you will be targeting the Parents demographic, we suggest not adding the age here. Or you can limit this later on when you get results. For campaigns targeting seniors, go for ages 50 and above.

Parents – You can target the following segments:

Parent of up to 12 months old kids

Parents with toddlers (1 to 2 years old)

Parents with preschoolers (3 to 5 years old)

Parents with early school-age children (6 to 8 years old)

Parents with preteens 9 to 12 years old)

Parents with teenagers (13 to 17 years old)

Now, these are still fairly broad, but it’s a good enough start. If you’d like to further narrow down your audience, here are targeting filters that you can require to match:

Household income – This can be used if you are targeting US zip codes.

top 25%-50% of ZIP codes (US)

top 10%-25% of ZIP codes (US)

top 10% of ZIP codes (US)

top 5% of ZIP codes (US)

Interest – While it would make sense to target people who’ve already shown interest in Insurance or Life insurance, you can also reach your target market through their other interests. This is called Cross Targeting and we’ll talk more about this later on.

TIP: Don’t make your targeting too narrow such that you hardly receive views or engagements. Highly targeted campaigns can be more expensive, which might cause you to pause the campaign before achieving significant results.

Finding Your Angle

Many affiliates think that targeting is the most important part and that once you’ve got that down, you’re all set.

Actually, no. Targeting is just one part of it.

This must be done in conjunction with having the right angle or approach to your ad.

Don’t just make a generic ad that promotes the basic features of your lead gen offer, such as receiving a quote fast or having a low premium.

Create ads that will resonate with your target audience. You already know them — the next part is catching their attention and making them feel the need to get life insurance.

Some possible angles for life insurance are:

Life insurance for parents with young children, making sure their children’s future is secure.

Life insurance for seniors who don’t have one yet or whose life insurance may not be enough.

Life insurance for parents who want to create generational wealth for their children.

Life insurance is affordable, or you can get life insurance for less.

Getting life insurance is necessary to avoid leaving the family in debt.

Press the Pain Points

Crafting your messaging to resonate with your audience involves understanding their needs, values, and concerns. In the case of life insurance, a key pillar of your messaging should be the concept of family. Family relationships are a profound motivator, and the idea of their well-being and security being potentially compromised can be a powerful call to action.

Create content that subtly but powerfully highlights the need to protect loved ones. Remind your audience about the inherent unpredictability of life and the peace of mind that comes from knowing their family will be financially secure, no matter what.

Phrases like “protecting your loved ones’ future” or “ensuring your family’s financial stability” can trigger emotional responses that encourage individuals to explore life insurance options.

Some even talk about recent events and trends to highlight the urgency of the situation. Take these ads, for example:

If you would notice, the advertisers used the prevalence of GoFundMe fundraisers for the expenses incurred by the unexpected death of a loved one.

This also adds a sense of urgency to the ad.

Adding urgency doesn’t necessarily mean using fear tactics, but rather, emphasizing the importance of timely action. The unpredictability of life can serve as a natural prompt.

Remember, your messaging should spark an emotional response and create a connection between the audience and the value proposition of life insurance.

Separate Market Segments

It’s possible that you’d like to target multiple market segments. If that is the case, it would be best to create different campaigns, ads, and landing pages per segment.

The reason? Not all market segments respond the same way to a single type of messaging or design. Each segment has distinct needs, challenges, motivations, and preferences.

By tailoring your content to each segment, you can speak directly to their specific pain points and aspirations. For instance, young parents might be more receptive to messages emphasizing the protection of their children’s future, whereas older individuals might resonate more with messages about financial stability during retirement.

Now, you can’t send young parents to a landing page that shows people in their senior years! Your target audience would immediately feel that the offer is not for them and would press the back or exit button faster than you can say, “Wait!”

Not only will you lose potential conversions, but you’d have already paid for the click with nothing to show for it.

The more relevant the ads and landing pages are to each other and to the target audience, the higher your chances of converting. It may seem like a lot of work, but it’s definitely worth it.

Cross-Target to Reach the Right People

Cross-targeting is a particularly effective strategy in the life insurance sector, allowing advertisers to reach a more specific and potentially responsive audience by combining multiple areas of interest.

Traditionally, if you’re in the life insurance business, your target audience would primarily consist of those who have shown an interest in life insurance products. But with cross-targeting, you can extend your reach to individuals interested in related areas like home improvement, DIY projects, retirement planning, health and wellness, or financial security.

For example, if you cross-match the Parent demographic to someone interested in Home Improvement or DIY projects, you find someone who is hands-on at home and shows interest in making home life better. That person values family, and talking about the unexpected while at home can trigger their desire for stability.

Similarly, those focused on health and wellness might be more receptive to the idea of life insurance as a part of long-term protection. These individuals typically understand the importance of maintaining good health and ensuring their longevity for the sake of their children.

They are likely to be responsive to life insurance ads that emphasize the security and peace of mind that life insurance can provide for their family’s future in the event of unforeseen circumstances.

By targeting these overlapping interests, you can reach potential customers who might not have been actively seeking life insurance but could be inclined to consider it when they see your ad. This approach broadens your audience, increases your ad’s relevance, and potentially improves conversion rates.

However, while cross-targeting can make your ad more relevant, ongoing monitoring and adjustment of your campaign based on performance data are crucial.

Not all combinations will yield positive results, so it’s vital to test and tweak your strategies as necessary to maximize the effectiveness of your life insurance marketing campaigns.

Selecting the Type of Facebook Ad to Use

Let’s get one thing out of the way first before we discuss ad types. While Facebook Lead Ads may initially seem like the most suitable option for promoting lead generation offers, the reality is somewhat different.

Unless the advertiser or affiliate network permits API integration, you can’t use Facebook Lead Ads. Therefore, rather than prioritizing this avenue, you should consider opting for Engagement, Link Clicks, or Page Views as your objectives and aim to send the user to your landing page.

When it comes to advertising life insurance on Facebook, two ad formats tend to be the most effective: image + text ads and video ads.

Image Ads

Image + text ads are often the go-to choice for many advertisers because of their simplicity and versatility. They consist of a catchy headline, a persuasive but concise body of text, and an eye-catching image.

For targeting parents with young children, your images should evoke a sense of family, security, and love. High-quality photographs depicting happy families can create an emotional connection with your audience. Images of parents spending quality time with their kids, such as playing in a park, reading a book together, or simply sharing a warm hug, can be very effective. Additionally, images that subtly reflect the concept of time or growth, like a child’s hand in a parent’s hand or a family tree, can underline the message of securing the future.

When targeting seniors, you can split-test the visuals you choose between:

reminding them of the realities of life (like a burial or mourning scene)

inspiring a positive outlook towards securing their loved ones’ future (like pictures featuring grandparents spending quality time with grandchildren).

Video Ads

Video ads, on the other hand, can add a dynamic element to your advertising efforts. You can weave relatable narratives that depict the importance of financial security for loved ones without having to include a lot of text in the ad itself.

Plus, it’s the most consumed media today, so you can’t go wrong with trying it out.

A key aspect to consider when using video ads on Facebook is to embed captions within the video itself.

As per Meta’s data, 85% of Facebook users watch videos with the sound muted by default. Therefore, including captions ensures that your message is conveyed effectively, regardless of whether viewers have their sound on or off.

TikTok-style videos also work well where the person tells the story of how having or not having life insurance made a significant impact.

You could feature a user sharing their own experience, showing how having life insurance provided a financial safety net for their family during an unexpected tragedy. Show the comfort and assurance it gave them, focusing on the emotional relief they felt knowing their little children’s future was secure.

On the other hand, sharing stories of people who didn’t have life insurance when a crisis struck can also highlight its significance. Stories of struggle, of families trying to cope with financial hardships alongside emotional loss, can serve as powerful reminders of what life insurance can prevent.

Creating Your Landing Page

Crafting a landing page not only attracts attention but also convinces visitors of the necessity and value of your offer, which can significantly increase your conversion rates. In short, you warm them up to the offer.

Why Use a Pre-lander?

We highly discourage sending traffic directly to the offer for the following reasons:

There is a disconnect between your ad and the landing page you take them to. This disconnect may lead to confusion on the side of the potential customer, possibly making them think that they landed on the wrong page. It might lead to a poor conversion rate.

Redirects are not allowed in Meta Ads, so if you want to direct link to the offer, you would have to use your affiliate link from the network you work with. This is risky since many other affiliates use the same domain and might have violated some of Facebook’s policies. If that’s the case, there’s a great chance your campaign will be rejected outright.

If you’re lucky, the affiliate offer you want to promote has its own bridge pages that can be downloaded as a zip and uploaded into your own hosting and under your own domain.

Make sure you create ads relevant to the pre-made landing pages through similar wording, by using images/videos taken from the page, and more.

Try Advertorials

Advertorials present a unique opportunity for promoting life insurance lead generation offers. These are essentially articles written in the style of news or editorial content, earning them more trust and credibility from readers than traditional advertisements.

An effectively crafted advertorial can subtly influence readers towards considering life insurance, without making them feel like they’re being directly sold to.

It can present genuine stories of families safeguarded by life insurance, underline the importance of financial protection in times of crisis, or offer expert opinions on the necessity of life insurance.

Customer-centric angles are highly effective.

Usher your audience into compelling narratives they can resonate with, making your offer more relatable.

For example:

“This 32-year-old father of two secured his $250k life insurance for only $10/month, saving $10 every month.”

Specificity is key; detail a story to paint a vivid picture of value and savings without implying the same result for the reader.

Your creatives’ tone greatly influences their impact. Strike a balance between professional and friendly. Be persuasive but not overly assertive.

Don’t forget to add your call-to-action.

You can pepper it within the content as text links, then add a very clear CTA button. If your page is long, you can use a floating CTA button so that it’s immediately (or always) visible to the user.

Add Disclaimers at the Bottom of the Page

Adding a disclaimer to your content that it does not substitute for professional financial advice is crucial for bridge pages like this.

This is essential to make sure Facebook will accept your landing page.

Life Insurance Lead Generation: Key Strategies and Best Practices for Facebook Ads

As an affiliate marketer, you probably already know how to create ad campaigns and pre-landers, so we won’t go into details about how to do that.

Instead, here are some tips to help you get your ads and landing pages approved in the platform and make them convert well for your life insurance offer.

1. Add required links.

Make sure you have working links to a Privacy Policy, the Terms & Conditions, and other data policies required by the country or state you are promoting in.

2. Never mislead your audience.

Don’t mislead the audience by stating the exact amounts they will get. Instead, say something like, “Customers can get life insurance for as low as $12 a month” or something similar.

It would be best to add a disclaimer stating that the policy depends on the client’s needs.

3. No Personal Attributes

Facebook’s No Personal Attributes rule states that you cannot talk about an audience’s personal characteristics on the ad or landing page as if you have personal knowledge of the potential customers you’re targeting. In short, don’t talk to the audience directly as if you know who they are.

The most straightforward way to respect this rule is to pivot the ad’s focus toward the product or service being offered. Emphasize the value and benefits it could bring to the type of customers your ad is designed for without implying you know them personally.

For example, you might be tempted to say this:

As a parent, you wouldn’t want to leave your family, especially your children, with tons of debt that they cannot repay due to your untimely death. This is why you need life insurance.

This will not be approved. If you want to say the same thing while respecting the No Personal Attributes rule, you can say:

Life insurance is perfect for parents who don’t want to leave their families, especially their kids, with a ton of debt due to an untimely death.

Avoiding personal attribution is actually pretty simple once you have a firm grasp of the concept. If you’re getting confused as to how this can be done, here’s a simple guide: make sure you don’t say “you” on your landing page (and ads, too).

4. Use tracking pixels.

Of course, you should add a Facebook pixel by default. But you may be wondering: what if I need to track my campaigns using a third-party affiliate tracker? If that’s the case, you should also add a tracking pixel from your tracker to your landing page. You can monitor views and conversions from there.

5. Quiz-type Landing Pages convert well.

If you’ll be using API to send leads, you can use quiz-type landing pages.

However, don’t bombard users with questions all at once. The more questions per page, the higher the chance the user will be turned off.

So make sure you split the questions into several pages and only ask questions that are necessary at that stage, ensuring that you gather just enough information to qualify a lead.

6. Add trust badges.

Include logos of the insurance providers you work with to ensure a smooth transition for users, avoiding any surprises or confusion. These serve as trust badges, too, especially if they include insurance providers that your audiences are familiar with.

However, it’s important to ensure that your advertiser permits this.

7. Add Click to Call buttons.

If you have a matching Pay Per Call offer, you can also use click-to-call buttons on the landing page, especially when targeting mobile users.

These are, of course, not the be-all and end-all of best practices, but these can get you started along the right path.

Final Thoughts

The key to successful Facebook ad campaigns, especially for white hat offers, is grounded in transparency, authenticity, and respect for the platform’s guidelines.

When crafting your messages, always trust your instincts. If an approach feels misleading and manipulative, or if your promises exceed what you can realistically deliver, it’s time to reassess.

Remember, the goal of running life insurance lead gen ads should be to build a sustainable, long-term business. Not only will your campaigns perform better, but the advertiser or affiliate network might even give you better deals or rates for providing consistent leads with good quality.

The post How to Promote Life Insurance Lead Generation Offers on Facebook appeared first on .

“}]] [[{“value”:”Lead Generation offers have always been one of the favorite verticals of many affiliates including me who has been obsessed

The post How to Promote Life Insurance Lead Generation Offers on Facebook appeared first on .”}]]